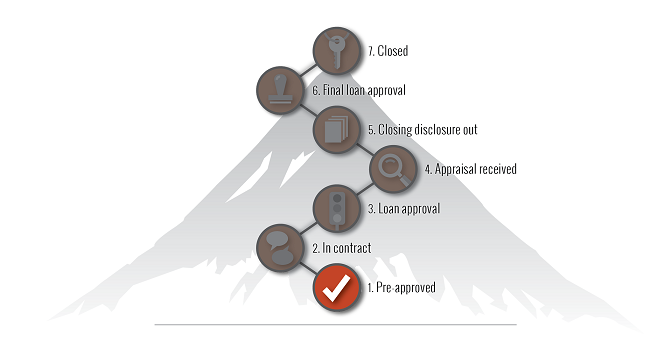

The Alaska Mortgage Momma Process

Even if you have purchased a home before, the mortgage process can be overwhelming. Our team strives to make the time we spend together as simple and as stress-free as possible. Check out our process from pre-approval to closing.

Pre-Approval

- Pre-application consultation if there are any questions we can answer, otherwise some clients jump to the next step!

- Online loan application completed

- We review your online loan application and follow up with any questions

- We request income and asset documents through a secure portal

- In some situations we need employment verification from current and/past employers. If this is needed, it will add some time to the pre-approval process.

- Once all documentation is received your file is processed, reviewed and a decision is issued.

- We send your pre-approval letter with any answers to outstanding questions

Your pre-approval is good as long as there are no drastic changes in your debt or income. Our credit reports expire every 120 days and our income and asset documents expire in 60 days. If either of those things happens before you move to the purchase phase we can easily update your pre-approval letter.

Shop for A Home

With your pre-approval letter in hand, you can start shopping for a home with your realtor. The pre-approval letter is your guide to how much you qualify to spend on your home. Once you find your dream home, you can make an offer. Once the offer is accepted we move into the next step.

Contract Review

After your offer has been accepted we get to work!

- Alaska Mortgage Momma team reviews your contract and registers it with our lending partner

- We lock in an interest rate for your loan

- One of our amazing loan processors is assigned to assist with a smooth transaction

- The loan processor submits for initial underwriting with our lending partner

- Title report ordered

- An appraisal is ordered and, once received shared with you and buyers and sellers realtors

- Loan processor works directly with you to make sure all documents that are needed are gathered and sent to the lender

Closing

- A closing disclosure is sent to you at lease 3 days prior to scheduled closing appointment

- Our lender issues a final loan approval and sends documents to the title company

- Title company draws up closing figures

- Alaska Mortgage Momma team communicates amount of cash needed to close

- Your realtor schedules your closing apppintment

- Attend closing appointment and sign all neccesary paperwork

- Enjoy your new home!